One of the more fascinating debates in the financial world for me the past few months is a debate regarding whether we are heading toward inflation or deflation. I follow many smart economists and market experts on both sides of this argument. After reading a lot of research papers with arguments on both sides, I am starting to form an opinion of my own. However, let’s start with a little background first.

Deflation since 2008

Back in 2011-2012, when I was just starting my education into macroeconomics, I became convinced that the Fed’s quantitative easing policies would lead to inflation. This view was a direct result of the finance and market “experts” I was following at the time. In fairness, there were a lot of smart people who got it wrong back then. I learned from that experience that economics is more complex and difficult to predict than you might imagine. It is not a science like physics or chemistry with certainty of principles, but in fact is more of a behavioral science. It was a painful lesson for me, with my portfolio suffering the consequences!

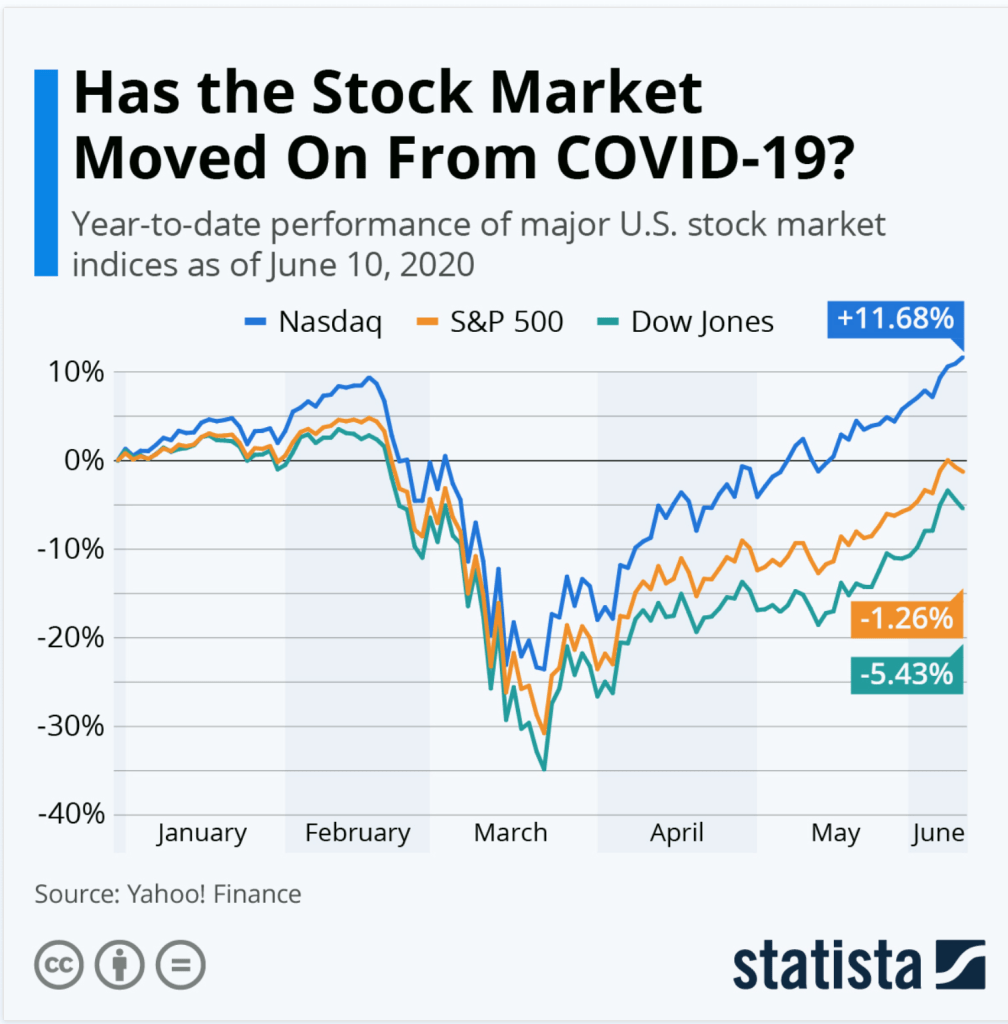

So where did those that I followed at the time get it wrong? I believe there were a couple of fallacies in that line of thinking. First, a lot of the liquidity that was generated by the Fed through the various rounds of QE did in fact cause inflation, but inflation of the financial markets, not the economy and consumer prices. The stock market rebounded from the late 2000s lows in large part due to the liquidity provided by the Fed and other central banks.

The other issue I did not discover until more recently, as I found more credible economists from which to learn. When central banks provide liquidity through quantitative easing, that liquidity does not necessarily find its way into the economy. And here is why. Remember, a central bank’s primary role is to provide liquidity, or in other words, funds available for loans, to regular banks. The idea is the additional availability of those funds will provide the ability of banks to provide financing for businesses. These loans will then go to businesses that will invest the loan proceeds in productive investments, thereby stimulating economic growth. And with that comes jobs growth, thereby pulling the country out of the recession. As economic growth ramps up and unemployment drops, this typically results a rise in prices as there are fewer workers for all of these new jobs.

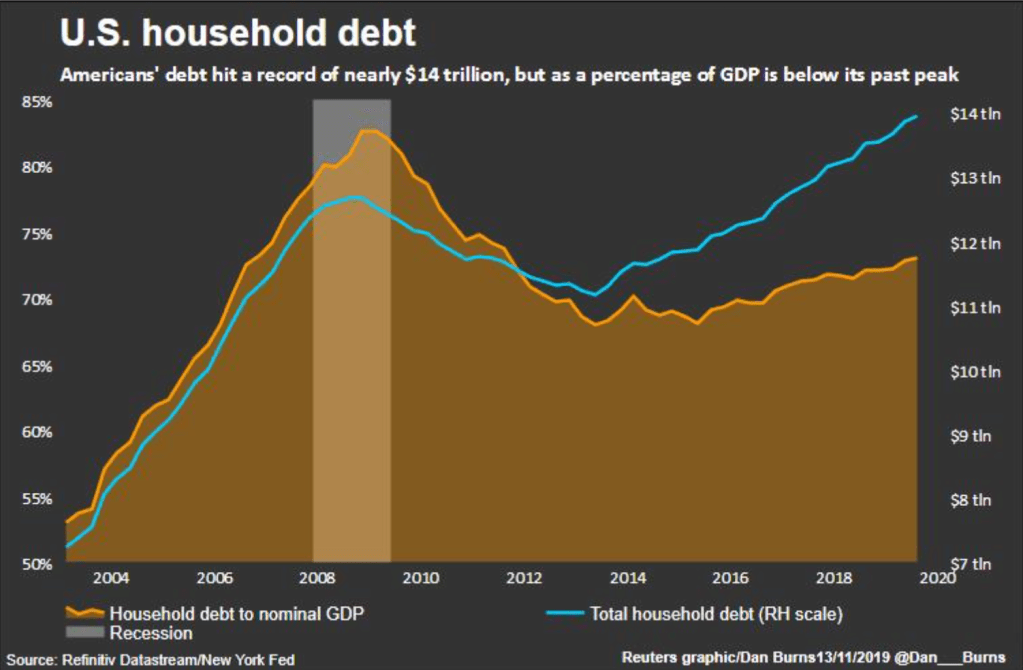

However, there is one little flaw in this line of thinking. No matter how much liquidity the Fed makes available to the banking system, there is nothing to force those banks to suddenly increase the amount of loans they are willing to make. Remember, when a bank makes a loan, the bank takes on repayment risk. Unless the bank is confident that borrowers can repay, then they do not have an incentive to make these loans. This was the missing link in the aftermath of the Global Financial Crisis for many forecasters.

The other challenge with creating inflation is that there are forces in the U.S. and most other developed markets today that are deflationary, with the primary force being the gentrification of the population and workforce. The developed world is aging. The baby boomers have been reaching retirement age for about 15 years now, so we are losing their productivity in the workforce. And compounding the problem, birth rates across developed markets has been on the decline for a number of years. So demographic forces today are extremely deflationary, as productivity and consumer demand drop.

The Fed’s policy shift

As an interesting aside, the Fed, in just the past two weeks, has made a significant shift in their mandate of stable prices. For a number of years, the Fed has interpreted this mandate as keeping inflation at no greater than 2% per year. In the past, the Fed would raise interest rates as the economy heated up in order to control inflation. This is typically called tightening. And as the business cycle played out, the Fed would tend to over-tighten, cutting off economic growth and pushing the economy into a recession. Interest rates would then be lowered to stimulate economic growth, starting the cycle over again.

On August 27, Fed chairman Jerome Powell made his annual speech in Jackson Hole, laying out a significant change in the future in regards to controlling inflation.

In a speech Thursday morning, Powell acknowledged the painful lessons of runaway inflation in the 1970’s, but warned that the persistence of low inflation over the last eight years risks new economic difficulties.

“Many find it counterintuitive that the Fed would want to push up inflation,” Powell said. But the Fed chief warned that low inflation leads to declining inflation expectations, which has the effect of “diminishing our capacity to stabilize the economy through cutting interest rates.”

The Fed’s target for inflation is 2%, measured as core personal consumption expenditures (which excludes volatile components like energy and food prices). But since establishing that goal in its 2012 Statement on Longer-Run Goals and Monetary Policy Strategy, the Fed has averaged inflation of only about 1.6%, touching 2% only briefly in 2018.

In 2019, the Fed launched a nationwide listening tour to see if it could tweak its statement with the objective of nudging inflation up toward its target.

On Thursday morning, Powell announced the conclusion of that review and said the policy-setting Federal Open Market Committee had unanimously approved new language that would allow for inflation moderately above 2% “for some time” following periods where inflation “has been running persistently” below that target.

Yahoo News, August 27, 2020 https://news.yahoo.com/jackson-hole-powell-unveils-effort-to-target-moderately-higher-inflation-131005405.html

For those of you who do not follow the Fed, here is a word of caution: They like to lie Don’t always believe what they say. So first, it is important to know that their measure of inflation, PCE, is crap not reality. Just in the quote above, it excludes energy and food. What? Does your family spend money on food? How about gas for the car? How convenient to just ignore this. How about spending on healthcare? Well, PCE bases health care costs only on medicare rates. Health insurance premiums? Ignored. Has that increased in price for your family recently? How about college tuition for the kids? Also ignored. So it is safe to say that the Fed’s inflation calculation of 1.6% inflation per year recently is actually quite bogus and severely understated.

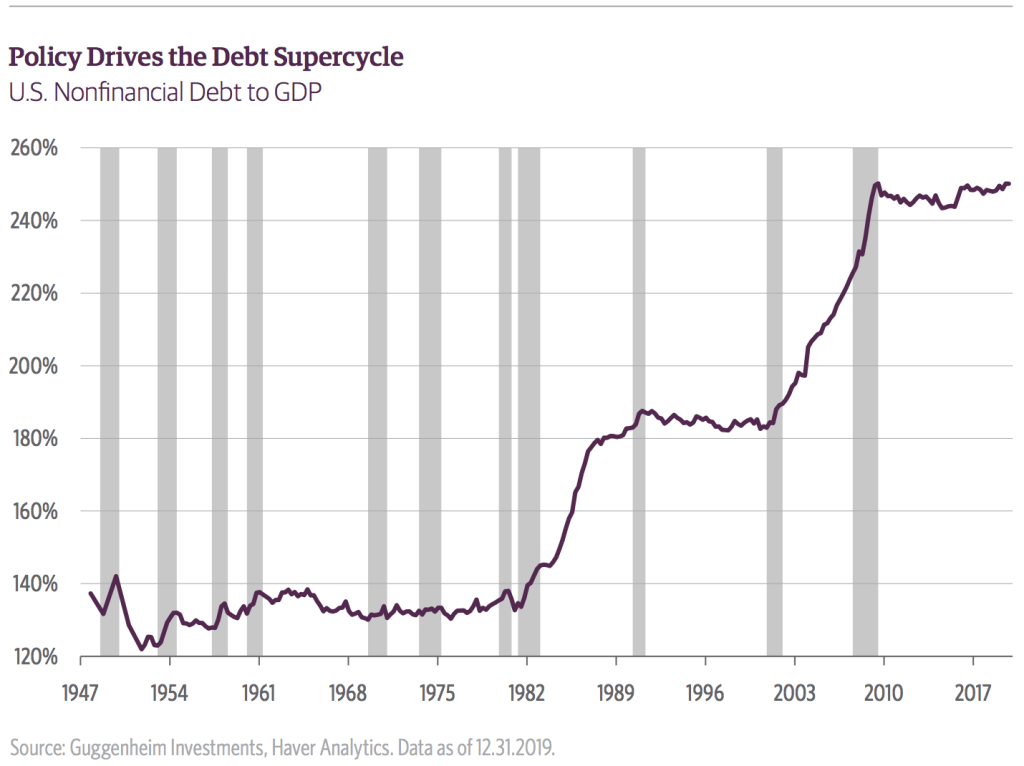

So next question, why do you think the Fed wants to push inflation up? First, here’s a dirty little secret. A better way to think of inflation is not an increase in prices. It is really a devaluation/debasement of our currency. That’s right, the good ole US dollar. So why devalue our currency? Well, take a look at the government’s balance sheet. We have run deficits for many years, and liabilities are skyrocketing this year to unprecedented levels. And there is no better way to minimize future debt servicing payments than to have a little high inflation/currency debasement.

I remember the first time I found out the amount of my parent’s house payment. It was probably around 1982. It was $88 a month! The house had been purchased in 1967, prior to the high inflation that occurred in the 1970’s. And you can bet that the house payment was much more of a stretch for my parents in the late 1960s than it was in 1980. That is the power of inflation on your debt.

But the flip side is that this phenomenon is just the opposite for savers. Quite frankly, savers get screwed when inflation increases. The spending power of their savings decreases year after year with high inflation. This is especially challenging for our seniors, who have no ongoing income and fixed savings and/or income.

In this week’s Thoughts From the Frontline newsletter from John Mauldin, titled “Inflation Virus Strikes Fed,” he addresses this policy change at the Fed. I have included a link to the newsletter for you to read in full (I highly recommend), so I will skip to John’s final thoughts on this change in inflation policy at the fed:

A few thoughts on the Fed’s twisting the concept of stable prices into a 2% inflation goal.

1. As noted above, 2% inflation cuts the buying power of your savings in half in just 36 years. Combined with a 0% interest rate policy, it means retirees following safe and prudent standards are guaranteed to lose buying power.

Whether you are just beginning to save for retirement, or you are already retired, such a policy makes you run faster just to stay in the same place. Yes, I understand that in a heavily indebted nation there is a perceived “need” for some level of inflation to lower the burden of debt. But lowering one man’s debt burden simultaneously reduces another man’s buying power.

All the words that the Federal Reserve used to describe this new policy never reveal exactly what time period they will use to achieve “average” 2% inflation. That makes a huge difference. It could mean letting run a, say, 4% for several years while keeping short-term interest rates near zero. Does anyone seriously believe that will have no consequence?

2. It follows from the above that at 4% inflation, longer-term interest rates would rise. This, of course, is not what the Fed wants. There is another “policy” being discussed in academic circles today: yield curve control. Will they have to control government rates all along the curve? That will have consequences too.

Further, the Fed now owns about a third of all US securitized mortgages. One. @#$%5ing. Third. Great for homebuyers. Will they continue this policy? How long? Will the US securitized mortgage market become like the Japanese bond market? That is to say, controlled by the central bank? The Federal Reserve is not buying jumbo loans. Does that mean jumbo loans will rise with inflation, shutting out wealthier people from buying homes, or at least larger homes, and driving down those home prices? Unintended consequences…

This massive manipulation of the bond market and the most important price in the world, the interest rate of the global reserve currency, is nothing but plain and simple price control. Can someone show me an instance where significant price controls actually worked over the long-term? Especially in a market this big? In the world’s reserve currency?

3. Which brings us to another unintended consequence, or at least I assume it is unintended. This is going to have a result of putting significant downward pressure on the dollar, causing commodity prices and US consumer prices to rise and exporting deflation to the rest of the world. The Aussie dollar is already up by 27%. The Europeans are complaining.

4. It is clear that the extraordinary quantitative easing has boosted equity prices. Not to mention home prices. That means that those with homes and equities have seen their net worth increase. For most of us reading this letter, that’s a good thing. But it also increases wealth and income disparity, which is tearing at the nation’s psychological roots. I don’t believe anyone at the Federal Reserve wants to increase wealth disparity, but that is the clear and obvious unintended consequence/result of their policy.

5. My friend David Bahnsen highlighted another point in a recent market commentary (emphasis mine):

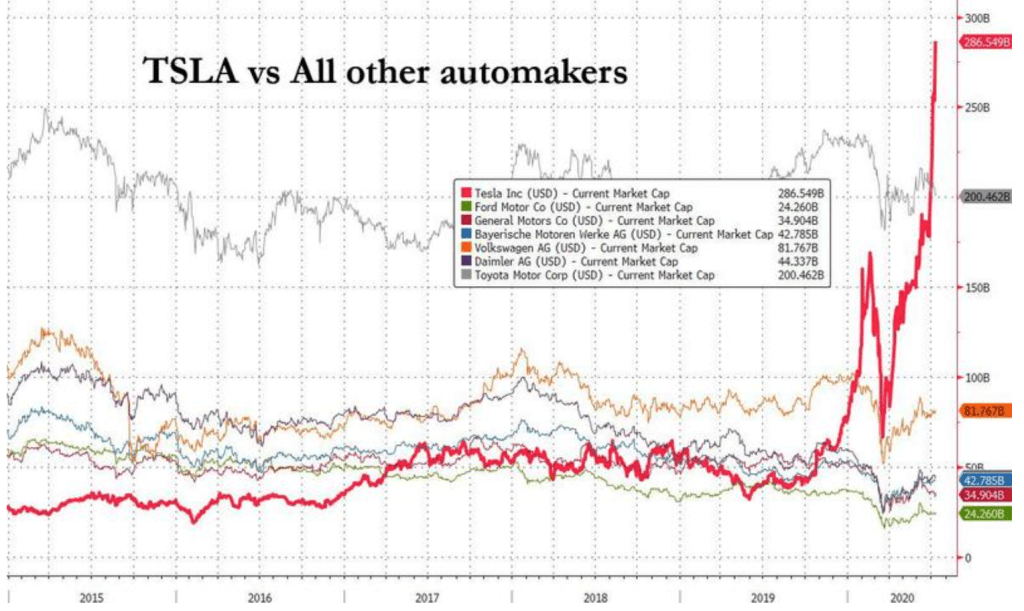

“But the impact of present Fed policy on the stock market extends well past the zero interest rate policy. In fact, rate policy has not even been the monetary tool that has most impacted the markets. The explosive interventions into debt markets, either through direct bond purchases (quantitative easing) or liquidity provisions (commercial paper, corporate debt, asset-backed securities) has had an incalculable impact on equity markets.

“Besides the basic reality of $3 trillion (and counting) of new reserves in the banking system and liquidity that finds its way into financial assets far easier than it does the real economy, how significant is it to corporate profitability to have borrowing costs reduced to their lowest level in history? Fed interventions in the corporate bond market (shockingly, both investment grade and high yield) have created extraordinary access to capital for companies that know how to use that capital quite productively.

“This pendulum shift cannot be overstated–many companies went from challenging business conditions with high cost of debt and limited access to new debt that they needed for this difficult time, to instead, less challenging conditions with brutally low cost of debt and unlimited access to capital needed for this time and useable for growth measures after this time. That shift from ‘what could have been’ to ‘what is’ in credit markets is the most underappreciated factor driving equity markets today.”

6. The combined impact of all this means that the Federal Reserve is putting its thumb on the scale between Wall Street and Main Street, between the haves and have-nots, between the wealthy and the middle class, let alone the poor. Not the intent, I get that. Powell and company are doing what they think will keep the economy moving forward. But intended or not, the consequences are still there. Is the average man on the street unjustified in thinking that “the elites,” whatever the hell that means, are not looking out for his best interest? When a struggling corporation accesses the debt markets because the Federal Reserve made it easy to do so, they are acting in the best interest of their shareholders. They are simply trying to stay afloat in a crisis. But restaurants, hair salons, and small businesses in general don’t have that same access because they don’t have the same experience or connections.

Thoughts From the Frontline, John Mauldin, 9/4/2020 https://www.mauldineconomics.com/frontlinethoughts/inflation-virus-strikes-fed

I covered some of John’s last point in my last article, and I must admit that reading it gets my blood boiling again. Our government is not doing much of anything helpful for our small businesses, which are critical for our economy, while on the other hand they are making funding more affordable and easily obtainable for larger corporations. The rich get richer…you know the rest. And you wonder why many in society are upset with the lack of justice and equality in our society? Somebody in our government had better wake up to the reality on main street USA. John summarizes my feelings in a much more diplomatic way.

We have come to this because a progression of “policy” decisions by the Federal Reserve and the US government backed us into a corner. No matter who wins the election in November, they will have no good choices. A $2 trillion deficit is not a good choice. And $2 trillion may not be enough to keep the wheels from falling off the economy.

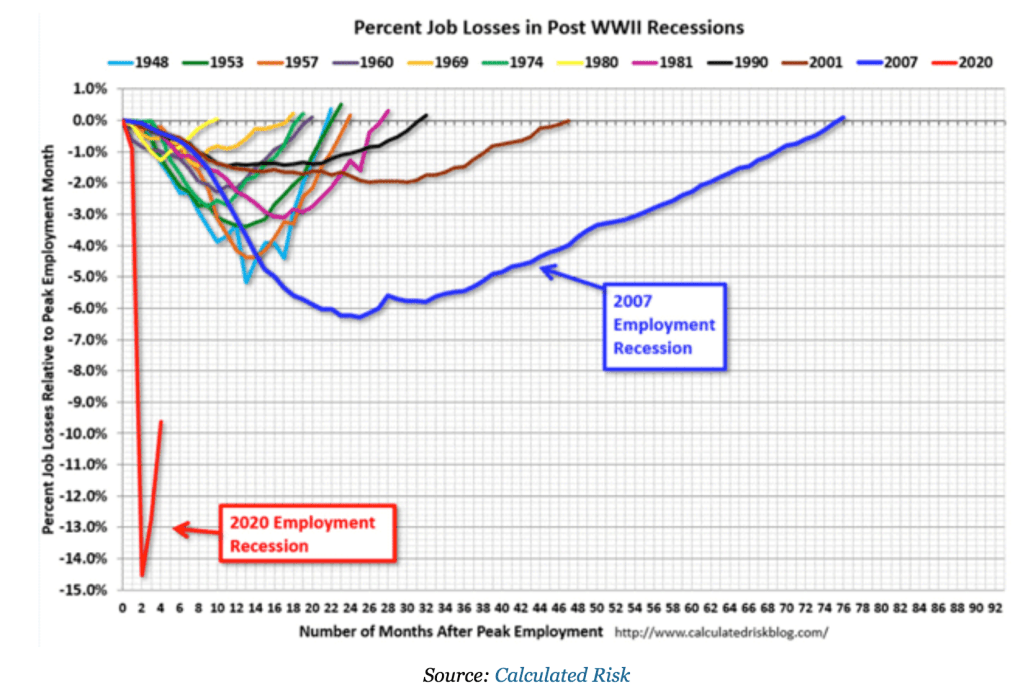

Small business America is getting slammed. It is clear that at least 100,000 small business will permanently close. That number could double over the next year. Every one of those businesses represents jobs, including many jobs for lower income Americans. Which is where the brunt of this crisis is being directed.

Thoughts From the Frontline, John Mauldin, 9/4/2020

Beware inflation

So, to recap, although there are certainly deflationary forces, primarily in the form of unfavorable demographics, in play, we see our government has motivation, desire, and the beginnings of a plan to create higher inflation. So which is it?

There is one big difference for me as I look at the deflation versus inflation argument, between 2008 and now. Back then, the Fed lowered interest rates and flooded the market with liquidity through quantitative easing just as now. But as I learned back then, the Fed cannot really create inflation on its own. Not when banks are hesitant to put that liquidity into action through loans. So what is different this time?

Quite simply, it is the actions of Congress and the President. The CARES act provided direct liquidity into our economy, through things like enhanced benefits for unemployment and other forms of direct financial support. This puts more dollars into our economy without any increase in production or output. So more dollars are chasing the same, or in some cases less, amount of goods available. There are other inflationary forces in play this time as well. We read about supply disruptions as western economies begin to look to cut supply chains emanating from China. This will be much more costly, especially if some of this manufacturing moves back home. So not only will we deal with higher labor and input costs, but product shortages will tend to drive prices higher as well.

This may take some time to materialize, so I am not sure how quickly this will begin to be felt fully. We are already seeing spikes in food prices, but what happens as tariffs for Chinese imports keep going up, or as companies begin to source products from other countries? It seems like more and more forces are aligning to start pushing prices higher.

And we are already seeing the US dollar begin to weaken against quite a few other currencies. This makes imported products more expensive as well. A lot of monetary experts expect this to continue for the foreseeable future. So don’t be surprised if your paycheck begins to be stretched more and more as we move through the next few years.

So, if inflation is coming, what should you do? One thing most prudent people should do is re-evaluate your asset portfolio. The types of investments that do well in inflationary times are precious metals, real estate, and any similar “real,” physical assets. Some stocks will tend to do well in inflationary times, while many others will not. Some bonds, such as TIPS bonds, are inflation-protected. I believe the primary reason gold and silver have performed so well over the past few months is because of this increasing fear of inflation. So it may be time to start thinking about whether a re-balancing of your investment portfolio is due.

PLEASE NOTE: As I am not a licensed investment advisor, please note that this is not investment advice. I suggest you contact your investment advisor for more direct guidance on how to structure your portfolio.