This week I am going to build on my last post of a couple of weeks ago and cover the central bank mis-steps in more recent times that are now putting the world at risk of significant economic shocks. Although the timing is difficult to predict, I expect the 2020s will be an extremely challenging decade, politically, socially, and economically. For more on why I believe we are on the cusp of these challenges, please read my previous post The Fourth Turning.

So first let’s recap a few key points from Part 1, as follows:

- The mis-steps began with the added mandate given to The Fed in 1978 to maintain full employment.

- This mandate is contradictory to the Fed’s primary mandate of maintaining price stability for a free-market, capitalist economy, as the process of “creative destruction” in a free market leads to business failures and temporary job losses.

- This has led to unprecedented sizes of central bank balance sheets across the world and increasing debt loads for many governments. Corporations and individuals are also maintaining high debt levels.

One key point I failed to cover in the last post is a key reason why it is now possible for governments to introduce unlimited amounts of money into circulation today. In 1971, President Richard Nixon made the decision to “temporarily” take the United States off the gold standard. Under the gold standard, all U.S. currency was convertible into gold. This acted as a control mechanism to limit the amount of currency that could be put into circulation, as there had to be enough gold in the vaults at the Federal Reserve Bank of New York and Fort Knox to support this convertibility. Oh, and 49 years later that “temporary” move off the gold standard has never been reversed.

Nothing lasts longer than a temporary government program.

President Ronald Reagan

I also want to expand a bit on the mandate on full employment. Yes, I know this sounds like a good thing. It is tough when people lose their jobs. But a key foundation of capitalism is a “survival of the fittest” environment where the strongest, most well-run businesses survive while weaker companies go away. This puts pressure on these businesses to continuously innovate and improve, and this is the environment that has created the strongest economy the world has ever seen. And the strides the world has made since the beginning of the industrial revolution is nothing short of miraculous. So capitalism has proven to be the best economic system for maintaining strong businesses, maintaining high productivity, and allowing standards of living to grow and citizens to thrive. It is not a perfect system, but so far it is the best that we as a civilization have devised.

On a personal note, I got laid off from my first job after graduating college with a degree in accounting. I graduated in December 1989, just as the world was starting to move toward a recession. The job market was also impacted for accountants by the consolidation of the “Big 8” accounting firms in late 1989, becoming the “Big 5.” So my first job was at an accounting firm near my hometown. This practice was primarily focused on tax preparation, and many clients were farmers. The farming industry had a bad year, and as we hit the slower period in August after wrapping up tax season and the few audits we had, I was laid off with the promise of being rehired in January. At the time, this was painful. But it really helped me to focus myself on dedicating the time and energy to study for the CPA exam and find a better job. I started a new job in November as a financial analyst at a failed savings and loan, but then was hired in December at a larger CPA firm in northwest Arkansas. This was a strong, well-respected regional firm with a much more diverse client base, and it was definitely a great step for my career. I stayed at that firm for almost three years, and then got an opportunity to join Walmart in the Internal Audit department, starting an incredible 25-year career. I now look back and can say in full confidence that being laid off was the best thing that could have happened to me!

Full Employment Mandate

So let’s explore the Fed’s full employment mandate further. As mentioned in my previous post, the Fed initially did not give much focus to this mandate. All through the 1980s the Fed Chairman Paul Volcker had his hands full getting inflation under control. So the U.S. spent the early years of the decade in recession until inflation started to finally come down. So not much happened early on after this new mandate.

Volcker was replaced by Alan Greenspan in 1988 as Fed Chairman. Under Greenspan’s leadership, things eventually began to change, where in order to maintain full employment, recessions needed to be eliminated or, worst case, at least minimized. As I think back to this time period, I also believe the 1992 presidential election was pivotal in bringing forward this change. George H. W. Bush was a popular president running for a second term in office. Two things stand out in this election for me. The first was Bush’s pledge in the 1988 campaign to not raise taxes. This is one failed promise that was a key focus on the election. But the other one is significant in regards to avoiding recessions and maintaining full employment. Bill Clinton’s campaign focused on the U.S. economy, which was in a recession in the early 1990s. In fact, one mantra of the campaign was, “It’s the economy, stupid.” Bush was by far the stronger candidate when it came to foreign policy and diplomacy, as a former member of the House of Representatives, Ambassador to the United Nations, and Director of the Central Intelligence Agency. Clinton had no federal government experience at all. So it was a brilliant strategy for his campaign to focus on the economy. And it worked! This set the tone for future presidents to also push to eliminate recessions. And although in theory the Fed is an independent agency not answerable to the president, in reality this is very much a blurred line, as many are seeing firsthand with President Trump’s numerous tweets that are critical of the Fed and it’s chairman, Jay Powell.

The graph above shows the effective Federal Funds Rate, the primary tool the Fed has historically used to ensure stable prices. In times of economic expansion and to control rising inflation, the Fed raises rates. You can see this in the above graph during the 19990s and 2004-2006 as the U.S. economy grew quickly. Conversely, the Fed lowers rates in response to a recession, in order to stimulate the economy into a new growth phase. This happened in 2000-2003 as the economy moved into a recession after the dot com bubble burst and also in 2007-2008 during as the financial crisis unfolded.

However, look what happened starting in 2008. Rates were kept extremely low through 2015, although the economic recovery began in 2011. Then the Fed attempted to raise rates in 2016-2018 (while at the same time reducing their balance sheet), resulting in declining markets and a faltering economy. These actions were quickly reversed.

Now let’s look at this graph, focusing on the blue line. When the financial crisis hit, the Targeted Fed Funds Rate was taken to 0% for the first time ever in history. And it wasn’t enough to get us out of the Global Financial Crisis. That was when the Fed (and other central banks) came up with a new tool called Quantitative Easing (QE). Since they could not take rates below 0% (or so they thought at the time!), the Fed increased its balance sheet, or in other words they flooded the economy with dollars. This gave banks more funds to lend to individuals and businesses. So not only could you get low interest rate loans, there was plenty of money being lent, making credit easily available. And the first round of QE did pull the economy out of the crisis. Yea Fed!

The aftermath of the financial crisis is when I believe the Fed fully decided to focus on the mandate to maintain full employment. The theory was now that rates could stay low, and the balance sheet (available funds to loan) could remain high, and the economy could continue to be stimulated, thereby avoiding severe recessions, maybe forever.

So you may wonder, what is the problem? Sounds great! Well, maybe it is too good to be true. Remember our discussion on capitalism. Taking this approach also eliminates the “creative destruction” that is necessary to maintain healthy companies, and ultimately a healthy economy. Is there proof that this is what the Fed believed could happen, eliminating severe recessions? Maybe a few quotes will help.

In my more than eighteen years at the Federal Reserve, much has surprised me, but nothing more than the remarkable ability of our economy to absorb and recover from the shocks of stock market crashes, credit crunches, terrorism, and hurricanes—blows that would have almost certainly precipitated deep recessions in decades past. This resilience, not evident except in retrospect, owes to a remarkable increase in economic flexibility, partly the consequence of deliberate economic policy and partly the consequence of innovations in information technology.

Alan Greenspan, Oct. 12, 2005 (before the Financial Crisis!!!)

Would I say there will never, ever be another financial crisis? You know probably that would be going too far but I do think we’re much safer and I hope that it will not be in our lifetimes and I don’t believe it will be.

Janet Yellen, former Fed Chairwoman 2014-2018, June 26, 2017

It’s the Debt, Stupid

So, if interest rates are held artificially low, and a significant amount of cash is maintained in the financial system from which to provide loans to to businesses, individuals, other governments, etc., what are the negative consequences?

The graph above shows the actual and projected U.S. Federal Government debt as a percent of GDP. The only time in our history when it was higher than today was during World War II, when the country had extremely high defense expenditures, and resulting debt, to support the war effort.

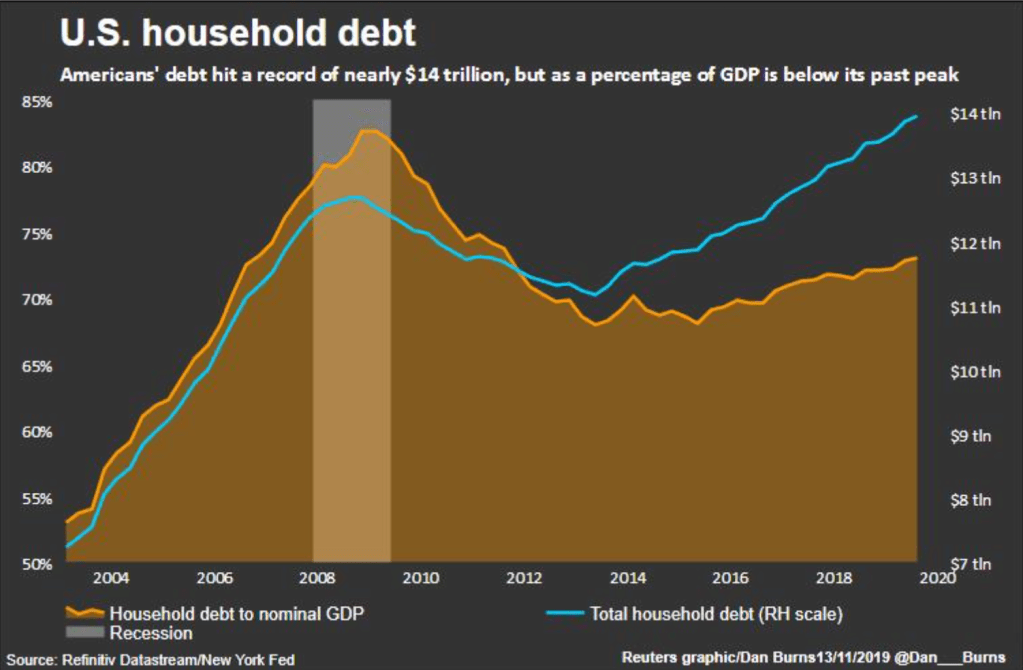

The easy money policies have also affected personal debt. There was a drop in personal debt after the financial crisis, as many people paid off debt, while others had their home foreclosed, eliminating their mortgage debt. However, you can see by the blue line that it has been growing again since 2013, although it is still lower as a percent of GDP than it was at the peak in 2009. Because of the Financial Crisis and resulting decrease in debt, the U.S. is in better shape in regards to consumer debt levels than many other countries.

Unfortunately, corporate debt is at disasterous levels! There is a reason why the Fed has had to intervene (illegally?) in the corporate debt market, including select purchases of investment grade (i.e. junk!) debt. There are many who believe this action is beyond the Fed’s authority, and I am one of them. Companies in dire financial straits should file for bankruptcy, not be bailed out by our government. Most bankruptcies result in a restructure if its finances, not a liquidation of the business. So the company survives, and usually with a majority of its employees. So I seriously doubt these bailouts have any significant impact on the number of layoffs.

The impact of all of this debt is that it is a significant drag on the economy. Some key points are as follows:

- Unproductive companies (commonly called zombie companies) that should have gone bankrupt through the creative destruction process are still operating, although at inefficient levels of production.

- More and more cash flow is now required to service the debt (i.e. pay the interest), leaving less cash to reinvest in the company or return to the owners.

- With so many zombie companies taking up market share, there are fewer and fewer attractive investments for companies that would otherwise look to grow. Alternatively, they end up buying back their stock and/or paying higher dividends to shareholders as there is no better use of these funds. There are even some companies that add debt (leverage) to their balance sheets in order to buy back their stock. In many cases this is done to increase their earnings per share (with no actual increase in dollar earnings, just fewer shares outstanding) in order to achieve targets for lucrative management bonuses. For me, this is gross mismanagement and a breach of fiduciary duties to the company. Many of these companies cannot survive and economic downturn because the balance sheet has been levered up to extreme levels. But those executives at least got their bonuses!

One of the smartest economists I have come across, Dr. Lacy Hunt of Hoisington Investment Management Company, has proven mathematically that as governments continue to increase their debt, each additional dollar of debt produces less in GDP.

The table above is from the Hoisington Quarterly Review and Outlook, Third Quarter 2019, and it compares the productivity of debt for selected countries for 2007-2009 versus the first quarter of 2019. For example, in the U.S. from 2007-2009, every dollar of debt produced $0.43 of GDP. However, in 2017 this drops to $0.40. Japan, with their extremely high government debt load, only produced $0.27 of GDP for every $1 of debt. And China has had the most significant drop in their debt productivity in this time frame.

Conclusion

So where does this leave us? We are at an unprecedented time in our fiscal and economic situation. We are basically trapped by our extreme levels of debt, and it is thanks to our central bank’s policies to try to minimize recessions over the past 20 years. We are getting to the point where central banks can no longer raise interest rates, because if they do, there will be a tremendous amount of companies filing for bankruptcy and even governments that cannot service their debts. In countries that have their own currency, they can always print more money to pay their debts, but this eventually leads to high levels of inflation, and eventually hyperinflation. The best solution would be to create economic growth to grow our way out of this situation. However, as discussed above, the extreme debt loads have eliminated this solution, as our debt burden has become too great. Because the world has never faced this situation, I am not sure anyone really knows how this plays out, although there are a lot of theories. At some point there must be a deleveraging process. And this will be extremely painful.

COVID-19 may have been the trigger that started this deleveraging process. Or the central banks, with their trillions in liquidity injections, may be able to delay the inevitable for a few more years. Regardless, I urge everyone to get prepared now. I believe everyone should have at least some small percentage of their portfolio in precious metals. Gold if possible. If you cannot afford gold, get some silver. And some of this should be coins or bars that are readily accessible to you if a crisis does hit. Be smart with your money and assets. Now may not be the time for luxury or discretionary purchases. As may of us learned from the pandemic, it is probably a good idea to have a few months supply of non-perishable food items. And face masks. And gloves. And some silver coins if your currency becomes worthless. As Pau Carter, Walmart’s first CFO, used to say when times got tough, “It is time to hunker down.”

And my final recommendation is to stay aware of the economic situation. Figure out the warning signs that problems may be imminent. If nothing else, follow this blog. I will do my best to keep everyone who reads this informed about our ever-changing economic environment. Share this website with others if you feel led to do so. Or find some smart economists and financial experts to follow.

I apologize if I sound like a doomsday fanatic. I have never been a pessimistic person, and I am still not. However, as I learned more and more about our current economic situation, from people far smarter than me, it woke me up to the need to plan for worst case scenarios. So I urge you to do that as well. We will make it through this difficult decade, and we can then look forward to better times ahead in the 2030s as we move into a new First Turning.

Going forward, now that I have covered a lot of background about what I have learned in the past 10 years, I plan to focus more on current economic events, the important developments I come across during the previous week. I will do my best to keep everyone informed, keeping our eyes wide open to what is happening around us, and around the world that may impact us. And there are some truly crazy, unbelievable things happening right now in financial markets. More next time.

I hope you have a great week,

Brent